SEBI Mandates New Rules for Derivative Indices to Prevent Stock Dominance

SEBI/Exchange

|

Updated on 30 Oct 2025, 06:49 pm

Reviewed By

Aditi Singh | Whalesbook News Team

Short Description :

▶

Detailed Coverage :

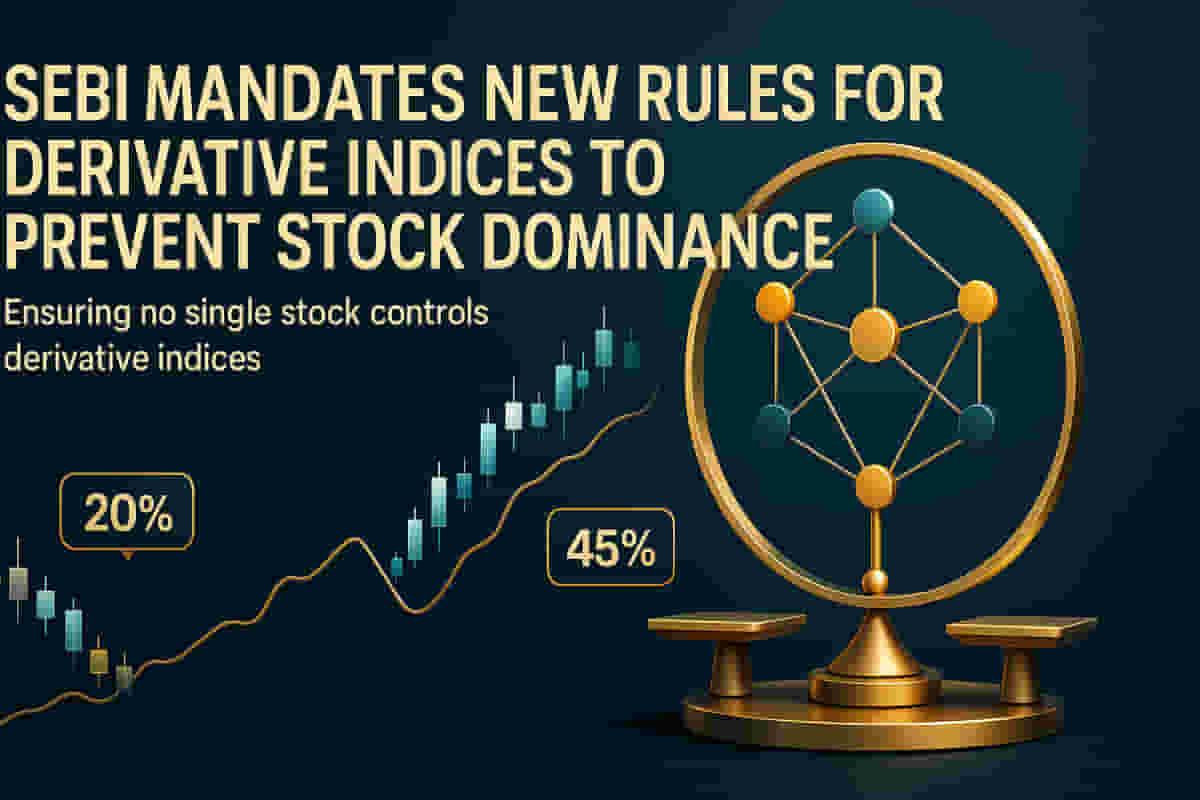

The Securities and Exchange Board of India (SEBI) has announced new regulations for stock exchanges concerning derivative products traded on non-benchmark indices. These additional norms aim to ensure that no single stock exerts undue influence over an index. Key requirements include a minimum of 14 constituents for such indices, a maximum weight of 20% for the top constituent, and a combined weight not exceeding 45% for the top three constituents. These rules apply to both existing and future derivative products on any other non-benchmark indices. The regulatory intent is to prevent manipulation, drawing lessons from cases like the analysis involving Jane Street, where dominant stock weights in indices were allegedly exploited. SEBI has provided specific implementation timelines: exchanges can adjust weights for Bankex and FinNifty in a single tranche, while BankNifty will have a four-month glide path for orderly rebalancing of assets tracking the index. The effective dates for these eligibility criteria have been extended to March 31, 2026, for BankNifty and December 31, 2025, for Bankex and FinNifty.

Impact These new regulations are expected to enhance the integrity and robustness of derivative indices by reducing concentration risk. This can lead to more stable pricing of derivative products and decrease opportunities for market manipulation, thereby fostering greater investor confidence in these instruments. Rating: 7/10.

Difficult Terms Derivative products: Financial contracts whose value is derived from an underlying asset, index, or group of assets. Non-benchmark indices: Stock market indices that are not considered primary or main indicators of market performance, such as Nifty or Sensex. Constituents: The individual stocks or assets that make up an index. Manipulation: The act of artificially inflating or deflating the price of a security or commodity through deceptive practices. Glide path: A phased approach to implementing changes over a specified period. Tranche: A portion or installment of a larger sum of money or a series of actions. Prudential norms: Rules or guidelines established to ensure financial stability and prudent risk management.

More from SEBI/Exchange

Latest News

Auto

Suzuki and Honda aren’t sure India is ready for small EVs. Here’s why.

Brokerage Reports

Stocks to buy: Raja Venkatraman's top picks for 4 November

Mutual Funds

Quantum Mutual Fund stages a comeback with a new CEO and revamped strategies; eyes sustainable growth

Tech

Why Pine Labs’ head believes Ebitda is a better measure of the company’s value

Banking/Finance

SEBI is forcing a nifty bank shake-up: Are PNB and BoB the new ‘must-owns’?

Industrial Goods/Services

India’s Warren Buffett just made 2 rare moves: What he’s buying (and selling)

Energy Sector

Energy

India's green power pipeline had become clogged. A mega clean-up is on cards.

Startups/VC Sector

Startups/VC

a16z pauses its famed TxO Fund for underserved founders, lays off staff

Energy Sector

India's green power pipeline had become clogged. A mega clean-up is on cards.

Startups/VC Sector