Indian Markets Open Flat Amidst Global Cues; Key Support Levels Monitored

Economy

|

31st October 2025, 4:13 AM

▶

Short Description :

Detailed Coverage :

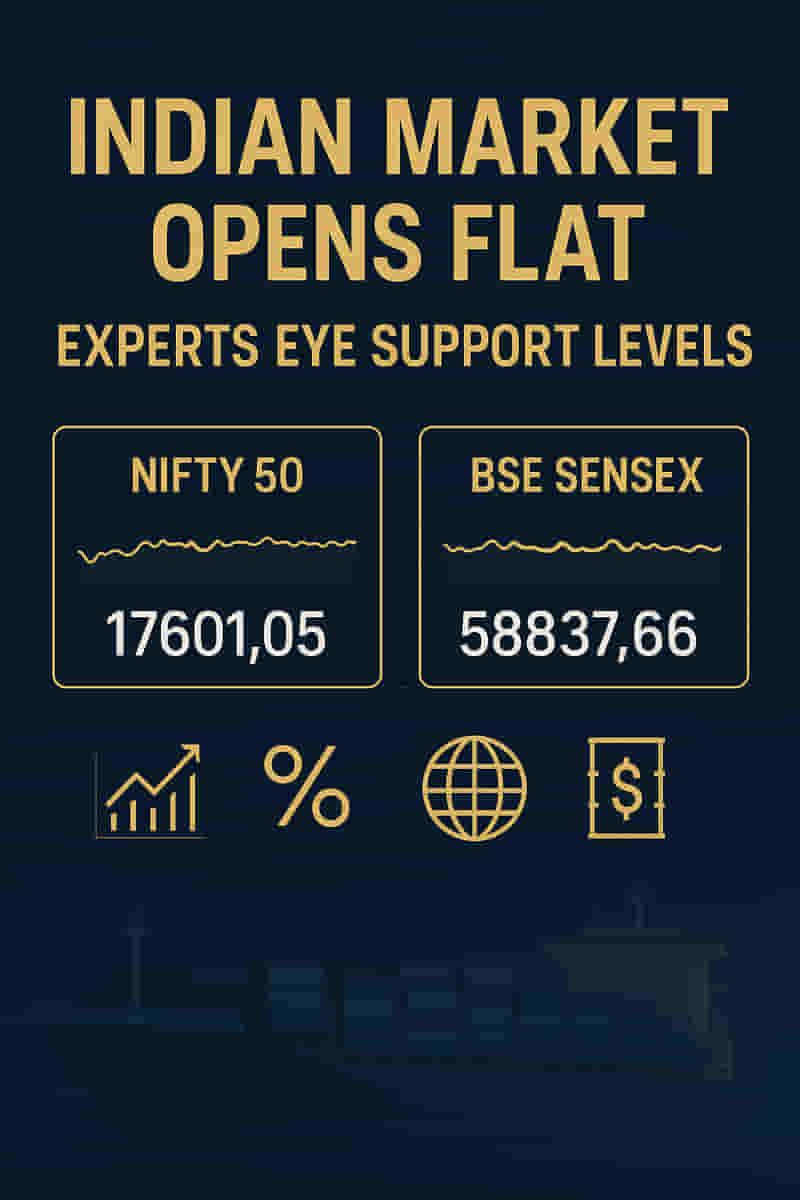

Indian equity indices, Nifty50 and BSE Sensex, commenced Friday's trading session flat, influenced by a mix of global market sentiment. The Nifty50 hovered around 25,850, while the BSE Sensex traded just below 84,400. Market analysts have identified key support levels at 25,800 and 25,700 for the Nifty50, suggesting that a breach of these levels could lead to further downward movement.

Dr. VK Vijayakumar, Chief Investment Strategist at Geojit Investments Limited, noted that the recent US-China summit only resulted in a one-year truce rather than a comprehensive trade deal, leading to disappointment among market participants, despite relief from de-escalating trade tensions.

He further observed that the Indian market rally is losing momentum as it approaches its September 2024 record high. Renewed selling pressure from Foreign Institutional Investors (FIIs) is expected to weigh on the market in the short term. The increasing short positions by FIIs indicate their view that Indian valuations are relatively high compared to earnings growth, a sentiment likely to change only with sustained earnings recovery.

However, Dr. Vijayakumar suggested that long-term investors can gradually accumulate fairly valued growth stocks, highlighting the significant long-term growth potential in shipping stocks due to India's recently announced grand maritime strategy involving substantial expenditure on the sector.

Globally, US stocks fell on Thursday, with Nasdaq and S&P 500 registering notable losses, partly due to concerns over increased AI expenditure by tech giants like Meta and Microsoft, and a sterner stance from the Federal Reserve. Conversely, Asian shares and US equity futures advanced earlier, buoyed by strong earnings from Apple Inc. and Microsoft Inc.

Oil prices declined, moving towards a third consecutive monthly drop, as a stronger dollar limited commodity gains, and increased production from major suppliers offset Western restrictions on Russian exports.

Foreign portfolio investors were net sellers of shares worth Rs 3,077 crore on Thursday, while domestic institutional investors were net buyers, purchasing shares worth Rs 2,469 crore.

Impact This news has a direct impact on the Indian stock market by influencing investor sentiment through global cues, FII activity, and specific domestic strategy announcements. The identification of support levels provides crucial technical guidance for traders and investors. The outlook on shipping stocks presents a specific investment opportunity. The overall impact on the Indian stock market is moderate to high, rated 7/10.

Difficult Terms:

FIIs (Foreign Institutional Investors): Overseas entities that invest in the stock markets of other countries.

Nifty50: A benchmark stock market index representing the average performance of 50 of the largest Indian companies listed on the National Stock Exchange.

BSE Sensex: A benchmark stock market index representing the performance of 30 large, well-established, and financially sound companies listed on the Bombay Stock Exchange.

Nasdaq Composite: A stock market index that lists all the stocks listed on the Nasdaq stock exchange.

S&P 500: An American stock market index consisting of the stocks of 500 large companies across top U.S. industries.

Federal Reserve: The central banking system of the United States.

US-China trade war: A period of escalating tariffs and trade restrictions between the United States and China.

Maritime strategy: A plan or policy related to a country's shipping, naval power, and oceanic interests.

Shipping stocks: Stocks of companies involved in the transportation of goods by sea.

Foreign portfolio investors (FPIs): Investors who invest in securities and assets of a country without direct management or control, often buying stocks and bonds.

Domestic institutional investors (DIIs): Local entities like mutual funds, insurance companies, and banks that invest in the domestic stock market.